Theil–Sen estimator: Difference between revisions

en>ChrisGualtieri m →Variations: Typo fixing, typos fixed: etc) → etc.) using AWB |

en>Fgnievinski Undid revision 580634903 by David Eppstein (talk) rationale given now |

||

| Line 1: | Line 1: | ||

In [[decision theory]] and quantitative [[policy analysis]], the '''expected value of including information (EVIU)''' is the expected difference in the value of a decision based on a [[probabilistic analysis]] versus a decision based on an analysis that ignores [[uncertainty]].<ref>{{cite book |author=Morgan, M. Granger and Henrion, Max |chapter=Chap. 12 |title=Uncertainty: A Guide to Dealing with Uncertainty in Quantitative Risk and Policy Analysis |publisher=Cambridge University Press |year=1990 |isbn=0-521-36542-2 }}</ref><ref>{{Cite thesis |degree=Ph.D. |title=The value of knowing how little you know: The advantages of a probabilistic treatment of uncertainty in policy analysis |author=Henrion, M. |year=1982 |publisher=Carnegie Mellon University }}</ref> | |||

== Background == | |||

Decisions must be made every day in the ubiquitous presence of uncertainty. For most day-to-day decisions, various [[heuristics]] are used to act reasonably in the presence of uncertainty, often with little thought about its presence. However, for larger high-stakes decisions or decisions in highly public situations, decision makers may often benefit from a more systematic treatment of their decision problem, such as through quantitative analysis. To facilitate methodical analysis, while retaining transparency in the decision making process, analysts make use of quantitative modeling software such as [[Analytica]]. The academic field that focuses on this style of decision making and analysis is known as [[decision analysis]]. | |||

When building a quantitative decision model, a model builder identifies various relevant factors, and encodes these as ''input variables''. From these inputs, other quantities, called ''result variables'', can be computed; these provide information for the decision maker. For example, in the example detailed below, I must decide how soon before my flight to leave for the airport (my decision). One input variable is how long it takes to drive from my house to the airport parking garage. From this and other inputs, the model can compute whether I'm likely to miss the flight and what the net cost (in minutes) will be for various decisions. | |||

To reach a decision, a very common practice is to ignore uncertainty. Decisions are reached through quantitative analysis and model building by simply using a ''best guess'' (single value) for each input variable. Decisions are then made on computed ''point estimates''. In many cases, however, ignoring uncertainty can lead to very poor decisions, with estimations for result variables often misleading the decision maker<ref>{{cite book |author=Danziger, Jeff; [http://www.drsamsavage.com Sam L. Savage] |title=The Flaw of Averages: Why We Underestimate Risk in the Face of Uncertainty |publisher=Wiley |location=New York |year=2009 |isbn=0-471-38197-7 |url=http://www.flawofaverages.com}}</ref> | |||

An alternative to ignoring uncertainty in quantiative decision models is to explicitly encode uncertainty as part of the model. Due to the adoption of powerful software tools such as [[Analytica]] that allows representations of uncertainty to be explicitly encoded, along with high availability of computation power, this practice is becoming more commonplace among [[decision analysis|decision analytic]] modelers. With this approach, a [[probability distribution]] is provided for each input variable, rather than a single best guess. The [[variance]] in that distribution reflects the degree of [[Bayesian probability|subjective uncertainty]] (or lack of knowledge) in the input quantity. The software tools then use methods such as [[Monte Carlo analysis]] to propagate the uncertainty to result variables, so that a decision maker obtains an explicit picture of the impact that uncertainty has on his decisions, and in many cases can make a much better decision as a result. | |||

When comparing the two approaches—ignoring uncertainty versus modeling uncertainty explicitly—the natural question to ask is how much difference it really makes to the quality of the decisions reached. In the 1960s, [[Ronald A. Howard]] proposed<ref>{{cite journal |author=Howard, Ron A. |title=Information value theory |journal=IEEE Transactions on Systems Science and Cybernetics |volume=1 |pages=22–6 |year=1966 }}</ref> one such measure, the [[expected value of perfect information]] (EVPI), a measure of how much it would be worth to learn the "true" values for all uncertain input variables. While providing a highly useful measure of sensitivity to uncertainty, the EVPI does not directly capture the actual improvement in decisions obtained from explicitly representing and reasoning about uncertainty. For this, Max Henrion, in his Ph.D. thesis, introduced the ''expected value of including uncertainty'' (EVIU), the topic of this article. | |||

== Formalization == | |||

Let | |||

:<math> | |||

\begin{array}{ll} | |||

d\in D & \text{the decision being made, chosen from space } D | |||

\\ | |||

x\in X & \text{the uncertain quantity, with true value in space } X | |||

\\ | |||

U(d,x) & \text{the utility function} | |||

\\ | |||

f(x) & \text{your prior subjective probability distribution (density function) on } x | |||

\end{array} | |||

</math> | |||

When not including uncertainty, you find the optimal decision using only <math>E[x]</math>, the expected value of the uncertain quantity. Hence, the decision ''ignoring uncertainty'' is given by: | |||

:<math> | |||

d_{iu} = {\arg\max_{d}} ~ U(d,E[x]) | |||

</math> | |||

The optimal decision taking uncertainty into account is the standard Bayes decision that maximizes expected utility: | |||

:<math> | |||

d^* = {\arg\max_d} {\int U(d,x) f(x) \, dx} | |||

</math> | |||

The EVIU is the difference in expected utility between these two decisions: | |||

:<math> | |||

EVIU = \int_{X} \left[ U(d^*,x) - U(d_{iu},x) \right] f(x) \, dx | |||

</math> | |||

The uncertain quantity ''x'' and decision variable ''d'' may each be composed of many scalar variables, in which case the spaces ''X'' and ''D'' are each vector spaces. | |||

== Example == | |||

[[File:EVIU diagram.png|frame|[[Analytica]] diagram of EVIU model]] | |||

The plane catching example described here is taken, with permission from [http://lumina.com Lumina Decision Systems], from an example model shipped with the [[Analytica]] visual modeling software. | |||

The diagram shows an [[influence diagram]] depiction of an [[Analytica]] model for deciding how early a person should leave home in order to catch a flight at the airport. The single decision, in the green rectangle, is the number of minutes that one will decide to leave prior to the plane's departure time. Four uncertain variables appear on the diagram in cyan ovals: The time required to drive from home to the airport's parking garage (in minutes), time to get from the parking garage to the gate (in minutes), the time before departure that one must be at the gate, and the loss (in minutes) incurred if the flight is missed. Each of these nodes contains a probability distribution, viz: | |||

Time_to_drive_to_airport := [[Lognormal Distribution|LogNormal]](median:60,gsdev:1.3) | |||

Time_from_parking_to_gate := [[Lognormal Distribution|LogNormal]](median:10,gsdev:1.3) | |||

Gate_time_before_departure := [[Triangular Distribution|Triangular]](min:20,mode:30,max:40) | |||

Loss_if_miss_the_plane := [[Lognormal Distribution|LogNormal]](median:400,stddev:100) | |||

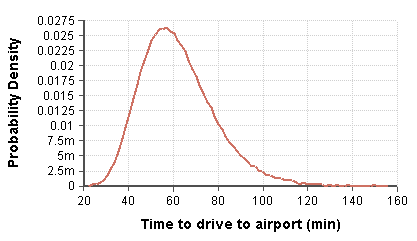

Each of these distributions is taken to be [[statistically independent]]. The probability distribution for the first uncertain variable, ''Time_to_drive_to_airport'', with [[median]] 60 and a [[geometric standard deviation]] of 1.3, is depicted in this graph: | |||

[[File:EVIU time to drive to airport.png]] | |||

The model calculates the cost (the red hexagonal variable) as the number of minutes (or minute equivalents) consumed to successfully board the plane. If one arrive too late, one will miss one's plane and incur the large loss (negative utility) of having to wait for the next flight. If one arrives too early, one incurs the cost of a needlessly long wait for the flight. | |||

Models that utilize EVIU may use a [[utility function]], or equivalently they may utilize a [[loss function]], in which case the [[utility function]] is just the negative of the [[loss function]]. In either case, the EVIU will be positive. The main difference is just that with a loss function, the decision is made by minimizing loss rather than by maximizing utility. The example here uses a [[loss function]], Cost. | |||

The definitions for each of the computed variables is thus: | |||

Time_from_home_to_gate := Time_to_drive_to_airport + Time_from_parking_to_gate + Loss_if_miss_the_plane | |||

Value_per_minute_at_home := 1 | |||

Cost := Value_per_minute_at_home * Time_I_leave_home + | |||

(If Time_I_leave_home < Time_from_home_to_gate Then Loss_if_miss_the_plane Else 0) | |||

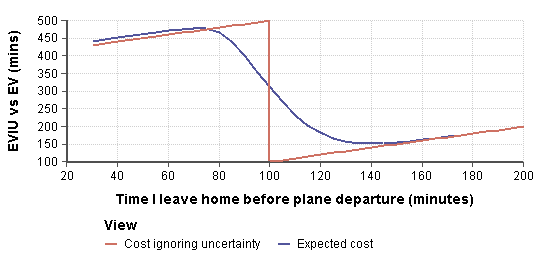

The following graph displays the expected value taking uncertainty into account (the smooth blue curve) to the expected utility ignoring uncertainty, graphed as a function of the decision variable. | |||

[[File:EVIU comparison.png]] | |||

When uncertainty is ignored, one acts as though the flight will be made with certainty as long as one leaves at least 100 minutes before the flight, and will miss the flight with certainty if one leaves any later than that. Because one acts as if everything is certain, the optimal action is to leave exactly 100 minutes (or 100 minutes, 1 second) before the flight. | |||

When uncertainty is taken into account, the expected value smooths out (the blue curve), and the optimal action is to leave 140 minutes before the flight. The expected value curve, with a decision at 100 minutes before the flight, shows the expected cost when ignoring uncertainty to be 313.7 minutes, while the expected cost when one leaves 140 minute before the flight is 151 minutes. The difference between these two is the EVIU: | |||

:<math>EVIU = 313.7 - 151 = 162.7\text{ minutes} \,</math> | |||

In other words, if uncertainty is explicitly taken into account when the decision is made, an average savings of 162.7 minutes will be realized. | |||

== Relation to expected value of perfect information (EVPI) == | |||

Both EVIU and [[EVPI]] compare the expected value of the Bayes' decision with another decision made without uncertainty. For EVIU this other decision is made when the uncertainty is ''ignored'', although it is there, while for [[EVPI]] this other decision is made after the uncertainty is ''removed'' by obtaining perfect information about ''x''. | |||

The [[EVPI]] is the expected cost of being uncertain about ''x'', while the EVIU is the additional expected cost of assuming that one is certain. | |||

The EVIU, like the EVPI, gives expected value in terms of the units of the utility function. | |||

==See also== | |||

*[[Expected value of perfect information]] (EVPI) | |||

*[[Expected value of sample information]] | |||

*[[Bulk Dispatch Lapse]] | |||

==References== | |||

{{Reflist}} | |||

{{DEFAULTSORT:Expected Value Of Including Uncertainty}} | |||

[[Category:Decision theory]] | |||

[[Category:Game theory]] | |||

Revision as of 22:51, 7 November 2013

In decision theory and quantitative policy analysis, the expected value of including information (EVIU) is the expected difference in the value of a decision based on a probabilistic analysis versus a decision based on an analysis that ignores uncertainty.[1][2]

Background

Decisions must be made every day in the ubiquitous presence of uncertainty. For most day-to-day decisions, various heuristics are used to act reasonably in the presence of uncertainty, often with little thought about its presence. However, for larger high-stakes decisions or decisions in highly public situations, decision makers may often benefit from a more systematic treatment of their decision problem, such as through quantitative analysis. To facilitate methodical analysis, while retaining transparency in the decision making process, analysts make use of quantitative modeling software such as Analytica. The academic field that focuses on this style of decision making and analysis is known as decision analysis.

When building a quantitative decision model, a model builder identifies various relevant factors, and encodes these as input variables. From these inputs, other quantities, called result variables, can be computed; these provide information for the decision maker. For example, in the example detailed below, I must decide how soon before my flight to leave for the airport (my decision). One input variable is how long it takes to drive from my house to the airport parking garage. From this and other inputs, the model can compute whether I'm likely to miss the flight and what the net cost (in minutes) will be for various decisions.

To reach a decision, a very common practice is to ignore uncertainty. Decisions are reached through quantitative analysis and model building by simply using a best guess (single value) for each input variable. Decisions are then made on computed point estimates. In many cases, however, ignoring uncertainty can lead to very poor decisions, with estimations for result variables often misleading the decision maker[3]

An alternative to ignoring uncertainty in quantiative decision models is to explicitly encode uncertainty as part of the model. Due to the adoption of powerful software tools such as Analytica that allows representations of uncertainty to be explicitly encoded, along with high availability of computation power, this practice is becoming more commonplace among decision analytic modelers. With this approach, a probability distribution is provided for each input variable, rather than a single best guess. The variance in that distribution reflects the degree of subjective uncertainty (or lack of knowledge) in the input quantity. The software tools then use methods such as Monte Carlo analysis to propagate the uncertainty to result variables, so that a decision maker obtains an explicit picture of the impact that uncertainty has on his decisions, and in many cases can make a much better decision as a result.

When comparing the two approaches—ignoring uncertainty versus modeling uncertainty explicitly—the natural question to ask is how much difference it really makes to the quality of the decisions reached. In the 1960s, Ronald A. Howard proposed[4] one such measure, the expected value of perfect information (EVPI), a measure of how much it would be worth to learn the "true" values for all uncertain input variables. While providing a highly useful measure of sensitivity to uncertainty, the EVPI does not directly capture the actual improvement in decisions obtained from explicitly representing and reasoning about uncertainty. For this, Max Henrion, in his Ph.D. thesis, introduced the expected value of including uncertainty (EVIU), the topic of this article.

Formalization

Let

When not including uncertainty, you find the optimal decision using only , the expected value of the uncertain quantity. Hence, the decision ignoring uncertainty is given by:

The optimal decision taking uncertainty into account is the standard Bayes decision that maximizes expected utility:

The EVIU is the difference in expected utility between these two decisions:

The uncertain quantity x and decision variable d may each be composed of many scalar variables, in which case the spaces X and D are each vector spaces.

Example

The plane catching example described here is taken, with permission from Lumina Decision Systems, from an example model shipped with the Analytica visual modeling software.

The diagram shows an influence diagram depiction of an Analytica model for deciding how early a person should leave home in order to catch a flight at the airport. The single decision, in the green rectangle, is the number of minutes that one will decide to leave prior to the plane's departure time. Four uncertain variables appear on the diagram in cyan ovals: The time required to drive from home to the airport's parking garage (in minutes), time to get from the parking garage to the gate (in minutes), the time before departure that one must be at the gate, and the loss (in minutes) incurred if the flight is missed. Each of these nodes contains a probability distribution, viz:

Time_to_drive_to_airport := LogNormal(median:60,gsdev:1.3) Time_from_parking_to_gate := LogNormal(median:10,gsdev:1.3) Gate_time_before_departure := Triangular(min:20,mode:30,max:40) Loss_if_miss_the_plane := LogNormal(median:400,stddev:100)

Each of these distributions is taken to be statistically independent. The probability distribution for the first uncertain variable, Time_to_drive_to_airport, with median 60 and a geometric standard deviation of 1.3, is depicted in this graph:

The model calculates the cost (the red hexagonal variable) as the number of minutes (or minute equivalents) consumed to successfully board the plane. If one arrive too late, one will miss one's plane and incur the large loss (negative utility) of having to wait for the next flight. If one arrives too early, one incurs the cost of a needlessly long wait for the flight.

Models that utilize EVIU may use a utility function, or equivalently they may utilize a loss function, in which case the utility function is just the negative of the loss function. In either case, the EVIU will be positive. The main difference is just that with a loss function, the decision is made by minimizing loss rather than by maximizing utility. The example here uses a loss function, Cost.

The definitions for each of the computed variables is thus:

Time_from_home_to_gate := Time_to_drive_to_airport + Time_from_parking_to_gate + Loss_if_miss_the_plane Value_per_minute_at_home := 1

Cost := Value_per_minute_at_home * Time_I_leave_home +

(If Time_I_leave_home < Time_from_home_to_gate Then Loss_if_miss_the_plane Else 0)

The following graph displays the expected value taking uncertainty into account (the smooth blue curve) to the expected utility ignoring uncertainty, graphed as a function of the decision variable.

When uncertainty is ignored, one acts as though the flight will be made with certainty as long as one leaves at least 100 minutes before the flight, and will miss the flight with certainty if one leaves any later than that. Because one acts as if everything is certain, the optimal action is to leave exactly 100 minutes (or 100 minutes, 1 second) before the flight.

When uncertainty is taken into account, the expected value smooths out (the blue curve), and the optimal action is to leave 140 minutes before the flight. The expected value curve, with a decision at 100 minutes before the flight, shows the expected cost when ignoring uncertainty to be 313.7 minutes, while the expected cost when one leaves 140 minute before the flight is 151 minutes. The difference between these two is the EVIU:

In other words, if uncertainty is explicitly taken into account when the decision is made, an average savings of 162.7 minutes will be realized.

Relation to expected value of perfect information (EVPI)

Both EVIU and EVPI compare the expected value of the Bayes' decision with another decision made without uncertainty. For EVIU this other decision is made when the uncertainty is ignored, although it is there, while for EVPI this other decision is made after the uncertainty is removed by obtaining perfect information about x.

The EVPI is the expected cost of being uncertain about x, while the EVIU is the additional expected cost of assuming that one is certain.

The EVIU, like the EVPI, gives expected value in terms of the units of the utility function.

See also

- Expected value of perfect information (EVPI)

- Expected value of sample information

- Bulk Dispatch Lapse

References

43 year old Petroleum Engineer Harry from Deep River, usually spends time with hobbies and interests like renting movies, property developers in singapore new condominium and vehicle racing. Constantly enjoys going to destinations like Camino Real de Tierra Adentro.

- ↑ 20 year-old Real Estate Agent Rusty from Saint-Paul, has hobbies and interests which includes monopoly, property developers in singapore and poker. Will soon undertake a contiki trip that may include going to the Lower Valley of the Omo.

My blog: http://www.primaboinca.com/view_profile.php?userid=5889534 - ↑ Template:Cite thesis

- ↑ 20 year-old Real Estate Agent Rusty from Saint-Paul, has hobbies and interests which includes monopoly, property developers in singapore and poker. Will soon undertake a contiki trip that may include going to the Lower Valley of the Omo.

My blog: http://www.primaboinca.com/view_profile.php?userid=5889534 - ↑ One of the biggest reasons investing in a Singapore new launch is an effective things is as a result of it is doable to be lent massive quantities of money at very low interest rates that you should utilize to purchase it. Then, if property values continue to go up, then you'll get a really high return on funding (ROI). Simply make sure you purchase one of the higher properties, reminiscent of the ones at Fernvale the Riverbank or any Singapore landed property Get Earnings by means of Renting

In its statement, the singapore property listing - website link, government claimed that the majority citizens buying their first residence won't be hurt by the new measures. Some concessions can even be prolonged to chose teams of consumers, similar to married couples with a minimum of one Singaporean partner who are purchasing their second property so long as they intend to promote their first residential property. Lower the LTV limit on housing loans granted by monetary establishments regulated by MAS from 70% to 60% for property purchasers who are individuals with a number of outstanding housing loans on the time of the brand new housing purchase. Singapore Property Measures - 30 August 2010 The most popular seek for the number of bedrooms in Singapore is 4, followed by 2 and three. Lush Acres EC @ Sengkang

Discover out more about real estate funding in the area, together with info on international funding incentives and property possession. Many Singaporeans have been investing in property across the causeway in recent years, attracted by comparatively low prices. However, those who need to exit their investments quickly are likely to face significant challenges when trying to sell their property – and could finally be stuck with a property they can't sell. Career improvement programmes, in-house valuation, auctions and administrative help, venture advertising and marketing, skilled talks and traisning are continuously planned for the sales associates to help them obtain better outcomes for his or her shoppers while at Knight Frank Singapore. No change Present Rules

Extending the tax exemption would help. The exemption, which may be as a lot as $2 million per family, covers individuals who negotiate a principal reduction on their existing mortgage, sell their house short (i.e., for lower than the excellent loans), or take part in a foreclosure course of. An extension of theexemption would seem like a common-sense means to assist stabilize the housing market, but the political turmoil around the fiscal-cliff negotiations means widespread sense could not win out. Home Minority Chief Nancy Pelosi (D-Calif.) believes that the mortgage relief provision will be on the table during the grand-cut price talks, in response to communications director Nadeam Elshami. Buying or promoting of blue mild bulbs is unlawful.

A vendor's stamp duty has been launched on industrial property for the primary time, at rates ranging from 5 per cent to 15 per cent. The Authorities might be trying to reassure the market that they aren't in opposition to foreigners and PRs investing in Singapore's property market. They imposed these measures because of extenuating components available in the market." The sale of new dual-key EC models will even be restricted to multi-generational households only. The models have two separate entrances, permitting grandparents, for example, to dwell separately. The vendor's stamp obligation takes effect right this moment and applies to industrial property and plots which might be offered inside three years of the date of buy. JLL named Best Performing Property Brand for second year running

The data offered is for normal info purposes only and isn't supposed to be personalised investment or monetary advice. Motley Fool Singapore contributor Stanley Lim would not personal shares in any corporations talked about. Singapore private home costs increased by 1.eight% within the fourth quarter of 2012, up from 0.6% within the earlier quarter. Resale prices of government-built HDB residences which are usually bought by Singaporeans, elevated by 2.5%, quarter on quarter, the quickest acquire in five quarters. And industrial property, prices are actually double the levels of three years ago. No withholding tax in the event you sell your property. All your local information regarding vital HDB policies, condominium launches, land growth, commercial property and more

There are various methods to go about discovering the precise property. Some local newspapers (together with the Straits Instances ) have categorised property sections and many local property brokers have websites. Now there are some specifics to consider when buying a 'new launch' rental. Intended use of the unit Every sale begins with 10 p.c low cost for finish of season sale; changes to 20 % discount storewide; follows by additional reduction of fiftyand ends with last discount of 70 % or extra. Typically there is even a warehouse sale or transferring out sale with huge mark-down of costs for stock clearance. Deborah Regulation from Expat Realtor shares her property market update, plus prime rental residences and houses at the moment available to lease Esparina EC @ Sengkang

![E[x]](https://wikimedia.org/api/rest_v1/media/math/render/svg/604728821497d9094bd347a8e27040b2ff58c88c)

![d_{{iu}}={\arg \max _{{d}}}~U(d,E[x])](https://wikimedia.org/api/rest_v1/media/math/render/svg/b30ebdb3e96173692ad8c1f7ecac270ed3a7d9e5)

![EVIU=\int _{{X}}\left[U(d^{*},x)-U(d_{{iu}},x)\right]f(x)\,dx](https://wikimedia.org/api/rest_v1/media/math/render/svg/96e5d5dfea393781a806a7be78104205a6d55005)