Light meter: Difference between revisions

en>ClueBot NG m Reverting possible vandalism by 200.77.10.82 to version by Verne Equinox. False positive? Report it. Thanks, ClueBot NG. (1178428) (Bot) |

en>Marcus Cyron m (Script) File renamed: File:Erkan Umut 2.jpg → File:Erkan Umut shoots Sibel Can.jpg File renaming criterion #1: Uploader requested.uploader request: please rename to fix the numbering may cause mi... |

||

| Line 1: | Line 1: | ||

{{Use mdy dates|date=September 2012}} | |||

{{Finance sidebar}} | |||

In [[economics]], the '''money supply''' or '''money stock''', is the total amount of [[money|monetary assets]] available in an [[economy]] at a specific time.<ref>Paul M. Johnson. "Money stock," [http://www.auburn.edu/~johnspm/gloss/money_stock A Glossary of Political Economy Terms]</ref> There are several ways to define "money," but standard measures usually include [[currency]] in circulation and [[demand deposits]] (depositors' easily accessed assets on the books of financial institutions).<ref>[[Alan Deardorff]]. "Money supply," [http://www-personal.umich.edu/~alandear/glossary/m.html Deardorff's Glossary of International Economics]</ref><ref>[[Karl Brunner (economist)|Karl Brunner]], "money supply," ''[[The New Palgrave: A Dictionary of Economics]]'', v. 3, p. 527.</ref> | |||

Money supply data are recorded and published, usually by the government or the [[central bank]] of the country. Public and private sector analysts have long monitored changes in money supply because of its effects on the [[price level]], [[inflation]], the [[exchange rate]] and the [[business cycle]].<ref>[http://www.newyorkfed.org/aboutthefed/fedpoint/fed49.html The Money Supply – Federal Reserve Bank of New York]. Newyorkfed.org.</ref> | |||

That relation between money and prices is historically associated with the [[quantity theory of money]]. There is strong [[empirical]] evidence of a direct relation between money-supply growth and long-term price inflation, at least for rapid increases in the amount of money in the economy. That is, a country such as [[Zimbabwe]] which saw rapid increases in its money supply also saw rapid increases in prices ([[hyperinflation]]). This is one reason for the reliance on [[monetary policy]] as a means of controlling inflation.<ref>[[Milton Friedman]] (1987). “quantity theory of money”, ''[[The New Palgrave: A Dictionary of Economics]]'', v. 4, pp. 15–19.</ref><ref name = "iwdef">{{cite web |url=http://www.investorwords.com/3110/money_supply.html|title= money supply Definition|accessdate=2008-07-20 }}</ref> | |||

The nature of this causal chain is the subject of contention. Some [[heterodox economics|heterodox economists]] argue that the money supply is endogenous (determined by the workings of the economy, not by the central bank) and that the sources of inflation must be found in the distributional structure of the economy.<ref>Lance Taylor: Reconstructing Macroeconomics, 2004</ref> | |||

In addition, those economists seeing the central bank's control over the money supply as feeble say that there are two weak links between the growth of the money supply and the inflation rate. First, in the aftermath of a recession, when many resources are underutilized, an increase in the money supply can cause a sustained increase in real production instead of inflation. Second, if the [[velocity of money]], i.e., the ratio between [[nominal GDP]] and money supply changes, an increase in the money supply could have either no effect, an exaggerated effect, or an unpredictable effect on the growth of nominal GDP. | |||

==Empirical measures in the United States Federal Reserve System== | |||

:''See also [[European Central Bank]] for other approaches and a more global perspective.'' | |||

[[Money]] is used as a [[medium of exchange]], a [[unit of account]], and as a ready [[store of value]]. Its different functions are associated with different [[empirical]] measures of the money supply. There is no single "correct" measure of the money supply. Instead, there are several measures, classified along a spectrum or continuum between narrow and broad ''monetary aggregates''. Narrow measures include only the most liquid assets, the ones most easily used to spend (currency, checkable deposits). Broader measures add less liquid types of assets (certificates of deposit, etc.). | |||

This continuum corresponds to the way that different types of money are more or less controlled by monetary policy. [[Narrow money supply|Narrow measures]] include those more directly affected and controlled by monetary policy, whereas [[broad money|broader measures]] are less closely related to monetary-policy actions.<ref name="iwdef"/> It is a matter of perennial debate as to whether narrower or broader versions of the money supply have a more predictable link to [[nominal GDP]]. | |||

The different types of money are typically classified as '''"M"s'''. The "M"s usually range from M0 (narrowest) to M3 (broadest) but which "M"s are actually focused on in policy formulation depends on the country's central bank. The typical layout for each of the "M"s is as follows: | |||

{| class="wikitable" | |||

|- | |||

! Type of money | |||

! M0 | |||

! MB | |||

! M1 | |||

! M2 | |||

! M3 | |||

! MZM | |||

|- | |||

| Notes and coins in circulation (outside Federal Reserve Banks and the vaults of depository institutions) ([[currency]]) | |||

| ✓<ref name="dollardaze.org">[http://dollardaze.org/blog/?post_id=00565 "Gold, Oil, Stocks, Investments, Currencies, and the Federal Reserve: Growth of Global Money Supply"]. DollarDaze Economic Commentary Blog by Mike Hewitt.</ref> | |||

| ✓ | |||

| ✓ | |||

| ✓ | |||

| ✓ | |||

| ✓ | |||

|- | |||

| Notes and coins in bank vaults ([[Vault Cash]]) | |||

| | |||

| ✓ | |||

| | |||

| | |||

| | |||

| | |||

|- | |||

| Federal Reserve Bank credit ([[required reserves]] and [[excess reserves]] not physically present in banks) | |||

| | |||

| ✓ | |||

| | |||

| | |||

| | |||

| | |||

|- | |||

| [[Traveler's cheque|Traveler's checks]] of non-bank issuers | |||

| | |||

|| | |||

| ✓ | |||

| ✓ | |||

| ✓ | |||

| ✓ | |||

|- | |||

| [[Demand deposit]]s | |||

| | |||

| | |||

| ✓ | |||

| ✓ | |||

| ✓ | |||

| ✓ | |||

|- | |||

| Other checkable deposits (OCDs), which consist primarily of [[Negotiable Order of Withdrawal]] (NOW) accounts at depository institutions and credit union share draft accounts. | |||

| | |||

| | |||

| ✓<ref>[http://research.stlouisfed.org/fred2/series/M1 M1 Money Stock (M1) – FRED – St. Louis Fed]. Research.stlouisfed.org.</ref> | |||

| ✓ | |||

| ✓ | |||

| ✓ | |||

|- | |||

| [[Savings deposit]]s | |||

| | |||

| | |||

| | |||

| ✓ | |||

| ✓ | |||

| ✓ | |||

|- | |||

| [[Time deposits]] less than $100,000 and [[Money market account|money-market deposit accounts]] for individuals | |||

| | |||

| | |||

| | |||

| ✓ | |||

| ✓ | |||

| | |||

|- | |||

|Large time deposits, institutional money market funds, short-term repurchase and other larger liquid assets<ref>[http://www.investopedia.com/terms/m/m3.asp M3 Definition]. Investopedia (February 15, 2009).</ref> | |||

| | |||

| | |||

| | |||

| | |||

| ✓ | |||

| | |||

|- | |||

|All money market funds | |||

| | |||

| | |||

| | |||

| | |||

| | |||

| ✓ | |||

|} | |||

* '''{{visible anchor|M0}}''': In some countries, such as the United Kingdom, M0 includes bank reserves, so M0 is referred to as the monetary base, or narrow money.<ref>[http://moneyterms.co.uk/m0/ M0 (monetary base)]. Moneyterms.co.uk.</ref> | |||

* '''MB''': is referred to as the [[monetary base]] or total currency.<ref name="dollardaze.org"/> This is the base from which other forms of money (like checking deposits, listed below) are created and is traditionally the most liquid measure of the money supply.<ref>{{cite web |url=http://www.investopedia.com/terms/m/m0.asp|title= M0|accessdate=2008-07-20 |publisher= Investopedia}}</ref> | |||

* '''M1''': Bank reserves are not included in M1. | |||

* '''M2''': Represents M1 and "close substitutes" for M1.<ref>{{cite web |url=http://www.investopedia.com/terms/m/m2.asp|title= M2|accessdate=2008-07-20 |publisher= Investopedia}}</ref> M2 is a broader classification of money than M1. M2 is a key economic indicator used to forecast inflation.<ref>{{cite web |url=http://www.investorwords.com/2909/M2.html|title= M2 Definition|accessdate=2008-07-20 |publisher= InvestorWords.com}}</ref> | |||

* '''M3''': M2 plus large and long-term deposits. Since 2006, M3 is no longer tracked by the US central bank.<ref name="fedM3disc">[http://www.federalreserve.gov/Releases/h6/discm3.htm Discontinuance of M3], Federal Reserve, November 10, 2005, revised March 9, 2006.</ref> However, there are still estimates produced by various private institutions. | |||

* '''MZM''': Money with zero maturity. It measures the supply of financial assets redeemable at par on demand. [[Velocity of money|Velocity]] of MZM is historically a relatively accurate predictor of [[inflation]].<ref>{{cite web|last=Aziz|first=John|title=Is Inflation Always And Everywhere a Monetary Phenomenon?|url=http://azizonomics.com/2013/03/10/is-inflation-always-and-everywhere-a-monetary-phenomenon/|work=Azizonomics|accessdate=2 April 2013|date=March 10, 2013}}</ref><ref>{{cite web|last=Thayer|first=Gary|title=Investors should assume that inflation will exceed the Fed's target|url=http://www.firstclearing.com/download/investors-should-assume-inflation-will-exceed-feds-target/|work=Macro Strategy|publisher=Wells Fargo Advisors|accessdate=2 April 2013|date=January 16, 2013}}</ref><ref>{{cite journal|last=Carlson|first=John B.|coauthors=Benjamin D. Keen|title=MZM: A monetary aggregate for the 1990s?|journal=Economic Review|year=1996|volume=32|issue=2|pages=15–23|url=http://clevelandfed.org/Research/Review/1996/96-q2-carlson.pdf|accessdate=2 April 2013|publisher=Federal Reserve Bank of Cleveland}}</ref> | |||

The ratio of a pair of these measures, most often M2 / M0, is called an (actual, empirical) [[money multiplier]]. | |||

===Fractional-reserve banking=== | |||

{{Main|Fractional-reserve banking}} | |||

The different forms of money in government money supply statistics arise from the practice of [[fractional-reserve banking]]. Whenever a bank gives out a loan in a fractional-reserve banking system, a new sum of money is created. This new type of money is what makes up the non-'''M0''' components in the '''M1-M3''' statistics. In short, there are two types of money in a fractional-reserve banking system:<ref name="bis">Bank for International Settlements – The Role of Central Bank Money in Payment Systems. See page 9, titled, "The coexistence of central and commercial bank monies: multiple issuers, one currency": http://www.bis.org/publ/cpss55.pdf | |||

A quick quote in reference to the 2 different types of money is listed on page 3. It is the first sentence of the document: | |||

:"Contemporary monetary systems are based on the mutually reinforcing roles of central bank money and commercial bank monies."</ref><ref name="ecb">European Central Bank – [http://www.ecb.int/press/key/date/2000/html/sp001109_2.en.html "Domestic payments in Euroland: commercial and central bank money"]: "At the beginning of the 20th almost the totality of retail payments were made in central bank money. Over time, this monopoly came to be shared with commercial banks, when deposits and their transfer via checks and giros became widely accepted. Banknotes and commercial bank money became fully interchangeable payment media that customers could use according to their needs. While transaction costs in commercial bank money were shrinking, cashless payment instruments became increasingly used, at the expense of banknotes"</ref> | |||

:#'''central bank money''' (obligations of a central bank, including currency and central bank depository accounts) | |||

:#'''commercial bank money''' (obligations of commercial banks, including checking accounts and savings accounts) | |||

In the money supply statistics, '''central bank money''' is '''MB''' while the '''commercial bank money''' is divided up into the '''M1-M3''' components. Generally, the types of commercial bank money that tend to be valued at lower amounts are classified in the narrow category of '''M1''' while the types of commercial bank money that tend to exist in larger amounts are categorized in '''M2''' and '''M3''', with '''M3''' having the largest. | |||

In the US, reserves consist of money in Federal Reserve accounts and US currency held by banks (also known as "vault cash").<ref>[http://www.investorwords.com/7260/vault_cash.html What is vault cash? definition and meaning]. Investorwords.com.</ref> Currency and money in Fed accounts are interchangeable (both are obligations of the Fed.) Reserves may come from any source, including the [[Federal funds|federal funds market]], deposits by the public, and borrowing from the Fed itself.<ref>[http://research.stlouisfed.org/fred2/series/NFORBRES Net Free or Borrowed Reserves of Depository Institutions (NFORBRES) – FRED – St. Louis Fed]. Research.stlouisfed.org.</ref> | |||

A reserve requirement is a ratio a bank must maintain between deposits and reserves.<ref>[http://www.federalreserve.gov/monetarypolicy/reservereq.htm FRB: Reserve Requirements]. Federal Reserve Bank.</ref> Reserve requirements do not apply to the amount of money a bank may lend out. The ratio that applies to bank lending is its [[capital requirement]].<ref>[http://wfhummel.cnchost.com/capitalrequirements.html Bank Capital Requirements]. Wfhummel.cnchost.com.</ref> | |||

==Example== | |||

'''Note:''' The examples apply when read in sequential order. | |||

'''M0''' | |||

* Laura has ten US $100 bills, representing $1000 in the M0 supply for the United States. (MB = $1000, M0 = $1000, M1 = $1000, M2 = $1000) | |||

* Laura [[Money burning|burns]] one of her $100 bills. The US M0, and her personal net worth, just decreased by $100. (MB = $900, M0 = $900, M1 = $900, M2 = $900) | |||

'''M1''' | |||

* Laura takes the remaining nine bills and deposits them in her [[transactional account]] (''checking account'' or ''current account'' by country) at her bank. (MB = $900, M0 = 0, M1 = $900, M2 = $900) | |||

* The bank then calculates its reserve using the minimum reserve percentage given by the Fed and loans the extra money. If the minimum reserve is 10%, this means $90 will remain in the bank's reserve. The remaining $810 can only be used by the bank as credit, by lending money, but until that happens it will be part of the bank's [[excess reserves]]. | |||

* The M1 money supply increases by $810 when the loan is made. M1 money is created. ( MB = $900 M0 = $810, M1 = $1710, M2 = $1710) | |||

* Laura writes a check for $400, check number 7771. The total M1 money supply didn't change, it includes the $400 check and the $500 left in her account. (MB = $900, M0 = 0, M1 = $1710, M2 = $1710) | |||

* Laura's check number 7771 is accidentally destroyed in the laundry. M1 and her checking account do not change, because the check is never cashed. (MB = $900, M0 = 0, M1 = $1710, M2 = $1710) | |||

* Laura writes check number 7772 for $100 to her friend Alice, and Alice deposits it into her checking account. MB does not change, it still has $900 in it, Alice's $100 and Laura's $800. (MB = $900, M0 = 0, M1 = $1710, M2 = $1710) | |||

* The bank lends Mandy the $810 credit that it has created. Mandy deposits the money in a checking account at another bank. The other bank must keep $81 as a reserve and has $729 available for loans. This creates a promise-to-pay money from a previous promise-to-pay, thus the M1 money supply is now inflated by $729. (MB = $900, M0 = 0, M1 = $2439, M2 = $2439) | |||

* Mandy's bank now lends the money to someone else who deposits it on a checking account on yet another bank, who again stores 10% as reserve and has 90% available for loans. This process repeats itself at the next bank and at the next bank and so on, until the money in the reserves backs up an M1 money supply of $9000, which is 10 times the MB money. (MB = $900, M0 = 0, M1 = $9000, M2 = $9000) | |||

'''M2''' | |||

* Laura writes check number 7774 for $1000 and brings it to the bank to start a Money Market account (these do not have a credit-creating charter), M1 goes down by $1000, but M2 stays the same. This is because M2 includes the Money Market account in addition to all money counted in M1. | |||

'''Foreign Exchange''' | |||

* Laura writes check number 7776 for $200 and brings it downtown to a foreign exchange bank teller at Credit Suisse to convert it to British Pounds. On this particular day, the exchange rate is exactly USD 2.00 = GBP 1.00. The bank Credit Suisse takes her $200 check, and gives her two £50 notes (and charges her a dollar for the service fee). Meanwhile, at the Credit Suisse branch office in Hong Kong, a customer named Huang has £100 and wants $200, and the bank does that trade (charging him an extra £.50 for the service fee). US M0 still has the $900, although Huang now has $200 of it. The £100 notes Laura walks off with are part of Britain's M0 money supply that came from Huang. | |||

* The next day, Credit Suisse finds they have an excess of GB Pounds and a shortage of US Dollars, determined by adding up all the branch offices' supplies. They sell some of their GBP on the open [[Foreign exchange market|FX]] market with Deutsche Bank, which has the opposite problem. The exchange rate stays the same. | |||

* The day after, both Credit Suisse and Deutsche Bank find they have too many GBP and not enough USD, along with other traders. Then, to move their inventories, they have to sell GBP at USD 1.999, that is, 1/10-cent less than $2 per pound, and the exchange rate shifts. None of these banks has the power to increase or decrease the British M0 or the American M0 (unless they burn bills); they are independent systems. | |||

==Money supplies around the world== | |||

=== United States {{anchor|M0|M1|M2|M3}} ===<!-- Many pages link to [[Money supply#M0]], ... --> | |||

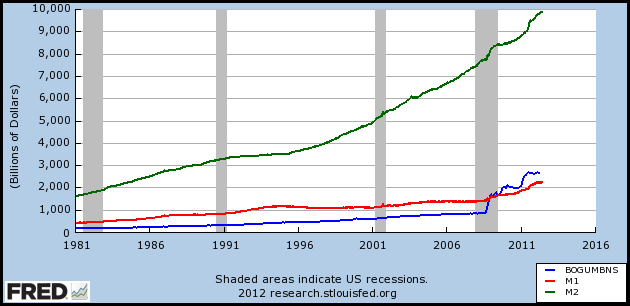

[[File:MB, M1 and M2 aggregates from 1981 to 2012.png|frame|MB, M1 and M2 from 1981 to 2012 – Further Information: [[Federal Reserve Bank of St. Louis]]<ref>http://research.stlouisfed.org/fred2/categories/24</ref>]] | |||

The Federal Reserve previously published data on three monetary aggregates, but on November 10, 2005 announced that as of March 23, 2006, it would cease publication of M3.<ref name="fedM3disc"/> Since the Spring of 2006, the Federal Reserve only publishes data on two of these aggregates. The first, M1, is made up of types of money commonly used for payment, basically currency (M0) and checking account balances. The second, M2, includes M1 plus balances that generally are similar to transaction accounts and that, for the most part, can be converted fairly readily to M1 with little or no loss of principal. The M2 measure is thought to be held primarily by households. As mentioned, the third aggregate, M3 is no longer published. Prior to this discontinuation, M3 had included M2 plus certain accounts that are held by entities other than individuals and are issued by banks and thrift institutions to augment M2-type balances in meeting credit demands; it had also included balances in money market mutual funds held by institutional investors. The aggregates have had different roles in monetary policy as their reliability as guides has changed. The following details their principal components:<ref name="paf">{{cite web|url=http://www.federalreserve.gov/pf/pf.htm |title=''The Federal Reserve – Purposes and Functions'' |publisher=Federalreserve.gov |date=2013-04-24 |accessdate=2013-12-11}}</ref> | |||

* '''M0''': The total of all physical currency including coinage. M0 = [[Federal Reserve Note]]s + [[United States Note|US Notes]] + [[Coins of the United States dollar|Coins]]. It is not relevant whether the currency is held inside or outside of the private banking system as reserves. | |||

* '''MB''': The total of all physical currency plus [[Federal Reserve Deposits]] (special deposits that only banks can have at the Fed). MB = [[Coins of the United States dollar|Coins]] + [[United States Note|US Notes]] + [[Federal Reserve Note]]s + [[Federal Reserve Deposits]] | |||

* '''M1''': The total amount of M0 (cash/coin) outside of the private banking system plus the amount of [[Demand deposit|demand deposits]], [[Traveler's cheque|travelers checks]] and [[Negotiable Order of Withdrawal account|other checkable deposits]] | |||

* '''M2''': M1 + most [[savings account]]s, [[money market account]]s, retail [[Money market fund|money market mutual funds]], and small denomination time deposits ([[certificates of deposit]] of under $100,000). | |||

* '''MZM''': 'Money Zero Maturity' is one of the most popular aggregates in use by the Fed because its [[Velocity of money|velocity]] has historically been the most accurate predictor of [[inflation]]. It is M2 – time deposits + money market funds | |||

* '''M3''': M2 + all other [[Certificate of deposit|CDs]] (large time deposits, institutional money market mutual fund balances), deposits of [[eurodollar]]s and [[repurchase agreement]]s. | |||

* '''M4-''': M3 + [[Commercial Paper]] | |||

* '''M4''': M4- + [[Treasury bill|T-Bills]] (or M3 + Commercial Paper + [[Treasury bill|T-Bills]]) | |||

* '''L''': The broadest measure of liquidity that the Federal Reserve no longer tracks. Pretty much M4 + [[Bankers' Acceptance]] | |||

* '''Money Multiplier''': M1 / MB. Currently as of June 14, 2012 it is .85. While a multiplier under one is historically an oddity, this is a reflection of the popularity of M2 over M1 and the massive amount of MB the government has created since 2008. | |||

It should be noted that while the treasury can and does hold cash and a special deposit account at the Fed (fed funds), these assets do not count in any of the aggregates. So in essence taxes paid to the Federal Government (Treasury) is excluded from the money supply. To counter this, the government created the TT&L program in which any receipts above a certain threshold are redeposited in private banks. The idea is that tax receipts won't decrease the amount of reserves in the banking system. The TT&L accounts, while demand deposits, do not count toward M1 or any other aggregate as well. | |||

When the Federal Reserve announced in 2005 that they would cease publishing M3 statistics in March 2006, they explained that M3 did not convey any additional information about economic activity compared to M2, and thus, "has not played a role in the monetary policy process for many years." Therefore, the costs to collect M3 data outweighed the benefits the data provided.<ref name="fedM3disc"/> Some politicians have spoken out against the Federal Reserve's decision to cease publishing M3 statistics and have urged the U.S. Congress to take steps requiring the Federal Reserve to do so. Congressman [[Ron Paul]] (R-TX) claimed that "M3 is the best description of how quickly the Fed is creating new money and credit. Common sense tells us that a government central bank creating new money out of thin air depreciates the value of each dollar in circulation."<ref>[http://www.lewrockwell.com/paul/paul319.html What the Price of Gold Is Telling Us]. Lewrockwell.com (April 25, 2006).</ref> [[Chartalism|Modern Monetary Theory]] disagrees. It holds that money creation in a free-floating fiat currency regime such as the U.S. will not lead to significant inflation unless the economy is approaching full employment and full capacity. Some of the data used to calculate M3 are still collected and published on a regular basis.<ref name="fedM3disc"/> Current alternate sources of M3 data are available from the private sector.<ref name="SgsM3Data">[http://www.shadowstats.com/alternate_data See, for example]. Shadowstats.com.</ref> | |||

As of April 2013, the [[monetary base]] was $3 trillion<ref>{{cite web|title=Aggregate Reserves of Depository Institutions and the Monetary Base – H.3|url=http://www.federalreserve.gov/releases/H3/Current/|publisher=[[Federal Reserve System{{!}}Federal Reserve]]|archiveurl=http://archive.is/doS2j|archivedate=16 June 2013}}</ref> and M2, the broadest measure of money supply, was $10.5 trillion.<ref>{{cite web|title=H.6 Money Stock Measures|url=http://www.federalreserve.gov/releases/h6/current/h6.htm|work=Federal Reserve Statistical Release|publisher=[[Federal Reserve System{{!}}Federal Reserve]]|archiveurl=http://archive.is/RrsRy|archivedate=16 June 2013}}</ref> | |||

===United Kingdom=== | |||

[[File:M4 money supply.svg|thumb|M4 money supply of the [[United Kingdom]] 1984–2007. In thousand millions (billions) of [[Pound sterling|pounds sterling]].]] | |||

There are just two official UK measures. M0 is referred to as the "wide [[monetary base]]" or "narrow money" and M4 is referred to as "[[broad money]]" or simply "the money supply". | |||

* '''M0''': Cash outside [[Bank of England]] + banks' operational deposits with Bank of England. (No longer published.) | |||

* '''M4''': Cash outside banks (i.e. in circulation with the public and non-bank firms) + private-sector retail bank and building society deposits + private-sector wholesale bank and building society deposits and certificates of deposit.<ref>[http://www.bankofengland.co.uk/mfsd/iadb/notesiadb/M4.htm www.bankofengland.co.uk] Explanatory Notes – M4 Retrieved August 13, 2007</ref> In 2010, the total money supply (M4) measure in the UK was £2.2 trillion while the actual notes and coins in circulation was only £47 billion, 2.1% of the actual money supply.<ref>Lipsey, R. G. and Chrystal, K. A. (2011). Economics, 12th Edition, Oxford | |||

University Press. p455</ref> | |||

There are several different definitions of money supply to reflect the differing stores of money. Due to the nature of bank deposits, especially time-restricted savings account deposits, the M4 represents the most [[liquidity|illiquid]] measure of money. M0, by contrast, is the most liquid measure of the money supply.{{-}} | |||

===Eurozone=== | |||

[[File:Euro money supply Sept 1998 - Oct 2007.jpg|thumb|The [[Euro]] money supply from 1998–2007.]] | |||

The [[European Central Bank]]'s definition of euro area monetary aggregates:<ref>[http://www.ecb.int/stats/money/aggregates/aggr/html/hist.en.html The ECB's definition of euro area monetary aggregates]</ref> | |||

* '''M1''': Currency in circulation + overnight deposits | |||

* '''M2''': M1 + deposits with an agreed maturity up to 2 years + deposits redeemable at a period of notice up to 3 months. | |||

* '''M3''': M2 + repurchase agreements + money market fund (MMF) shares/units + debt securities up to 2 years | |||

{{-}} | |||

===Australia=== | |||

[[File:Money supply of Australia 1984-2007.jpg|thumb|The money supply of [[Australia]] 1984–2007]] | |||

The [[Reserve Bank of Australia]] defines the monetary aggregates as:<ref>[http://www.rba.gov.au/Glossary/text_only.asp RBA: Glossary – Text Only Version]{{dead link|date=September 2012}}</ref> | |||

* '''M1''': currency bank + current deposits of the private non-bank sector | |||

* '''M3''': M1 + all other bank deposits of the private non-bank sector | |||

* '''Broad Money''': M3 + borrowings from the private sector by NBFIs, less the latter's holdings of currency and bank deposits | |||

* '''Money Base''': holdings of notes and coins by the private sector plus deposits of banks with the Reserve Bank of Australia (RBA) and other RBA liabilities to the private non-bank sector | |||

{{-}} | |||

===New Zealand=== | |||

[[File:New zealand money supply 1988-2008.jpg|thumb|[[New Zealand]] money supply 1988–2008]] | |||

The [[Reserve Bank of New Zealand]] defines the monetary aggregates as:<ref>[http://www.rbnz.govt.nz/statistics/tables/c1/ Series description – Monetary and financial statistics]. Rbnz.govt.nz.</ref> | |||

* '''M1''': notes and coins held by the public plus chequeable deposits, minus inter-institutional chequeable deposits, and minus central government deposits | |||

* '''M2''': M1 + all non-M1 call funding (call funding includes overnight money and funding on terms that can of right be broken without break penalties) minus inter-institutional non-M1 call funding | |||

* '''M3''': the broadest monetary aggregate. It represents all New Zealand dollar funding of M3 institutions and any Reserve Bank repos with non-M3 institutions. M3 consists of notes & coin held by the public plus NZ dollar funding minus inter-M3 institutional claims and minus central government deposits | |||

{{-}} | |||

===India=== | |||

[[File:India Money Supply Components--Larger Label Fonts.png|thumb|Components of the money supply of [[India]] in billions of [[Rupee]] for 1950–2011]] | |||

The [[Reserve Bank of India]] defines the monetary aggregates as:<ref>[http://rbidocs.rbi.org.in/rdocs/Publications/PDFs/80441.pdf "Handbook of Statistics on Indian Economy"]. See the document at the bottom of the page titled, "Notes on Tables". The definitions are on the fourth page of the document</ref> | |||

* '''Reserve Money (M0)''': Currency in circulation + Bankers’ deposits with the RBI + ‘Other’ deposits with the RBI = Net RBI credit to the Government + RBI credit to the commercial sector + RBI’s claims on banks + RBI’s net foreign assets + Government’s currency liabilities to the public – RBI’s net non-monetary liabilities. | |||

* '''M1''': Currency with the public + Deposit money of the public (Demand deposits with the banking system + ‘Other’ deposits with the RBI). | |||

* '''M2''': M1 + Savings deposits with Post office savings banks. | |||

* '''M3''': M1+ Time deposits with the banking system = Net bank credit to the Government + Bank credit to the commercial sector + Net foreign exchange assets of the banking sector + Government’s currency liabilities to the public – Net non-monetary liabilities of the banking sector (Other than Time Deposits). | |||

* '''M4''': M3 + All deposits with post office savings banks (excluding National Savings Certificates). | |||

{{-}} | |||

===Japan=== | |||

[[File:Money supply of japan.gif|thumb|[[Japan]]ese money supply (April 1998 – April 2008)]] | |||

The [[Bank of Japan]] defines the monetary aggregates as:<ref>[http://www.boj.or.jp/en/type/exp/stat/exms01.htm click on the link to the exms01.pdf file. They are defined in Appendix 1 which on the 11th page of the pdf.]{{dead link|date=September 2012}}</ref> | |||

* '''M1''': cash currency in circulation + deposit money | |||

* '''M2 + CDs''': M1 + [[quasi-money]] + CDs | |||

* '''M3 + CDs''': (M2 + CDs) + deposits of post offices + other savings and deposits with financial institutions + money trusts | |||

* '''Broadly defined liquidity''': (M3 + CDs) + money market + pecuniary trusts other than money trusts + investment trusts + bank debentures + commercial paper issued by financial institutions + repurchase agreements and securities lending with cash collateral + government bonds + foreign bonds | |||

{{-}} | |||

==Link with inflation== | |||

===Monetary exchange equation=== | |||

Money supply is important because it is linked to inflation by the [[equation of exchange]] in an equation proposed by Irving Fisher in 1911:<ref>The Purchasing Power of Money, its Determination and Relation to Credit, Interest and Crises, Irving Fisher. [http://files.libertyfund.org/files/1165/Fisher_0133_EBk_v5.pdf Online Library Of Liberty]</ref> | |||

: <math>M*V = P*Q</math> | |||

where | |||

* <math>M</math> is the total dollars in the nation’s money supply, | |||

* <math>V</math> is the number of times per year each dollar is spent (velocity of money), | |||

* <math>P</math> is the average price of all the goods and services sold during the year, | |||

* <math>Q</math> is the quantity of assets, goods and services sold during the year. | |||

In mathematical terms, this equation is really an [[Identity (mathematics)|identity]] which is true by definition rather than describing economic behavior. That is, each term is defined by the values of the other three. Unlike the other terms, the velocity of money has no independent measure and can only be estimated by dividing PQ by M. [[Monetarism|Some adherents]] of the quantity theory of money assume that the velocity of money is stable and predictable, being determined mostly by financial institutions. If that assumption is valid then changes in M can be used to predict changes in PQ. If not, then a model of V is required in order for the equation of exchange to be useful as a macroeconomics model or as a predictor of prices. | |||

Most macroeconomists replace the equation of exchange with equations for the [[demand for money]] which describe more regular and predictable economic behavior. However, predictability (or the lack thereof) of the velocity of money is equivalent to predictability (or the lack thereof) of the demand for money (since in equilibrium real money demand is simply ''Q''/''V''). Either way, this unpredictability made policy-makers at the [[Federal Reserve]] rely less on the money supply in steering the U.S.economy. Instead, the policy focus has shifted to [[interest rate]]s such as the [[fed funds rate]]. | |||

In practice, macroeconomists almost always use real GDP to measure Q, omitting the role of all transactions except for those involving newly produced goods and services (i.e., consumption goods, investment goods, government-purchased goods, and exports). That is, the only assets counted as part of Q are newly produced investment goods. But the original quantity theory of money did not follow this practice: PQ was the monetary value of all new transactions, whether of real goods and services or of paper assets. | |||

[[File:Us proportionate m3.svg|thumb|[[United States|U.S.]] M3 money supply as a proportion of [[gross domestic product]].]] | |||

The monetary value of assets, goods, and service sold during the year could be grossly estimated using nominal GDP back in the 1960s. This is not the case anymore because of the dramatic rise of the number of financial transactions relative to that of real transactions up until 2008. That is, the total value of transactions (including purchases of paper assets) rose relative to nominal GDP (which excludes those purchases). | |||

Ignoring the effects of monetary growth on real purchases and velocity, this suggests that the growth of the money supply may cause different kinds of inflation at different times. For example, rises in the U.S. money supplies between the 1970s and the present encouraged first a rise in the inflation rate for newly produced goods and services ("inflation" as usually defined) in the seventies and then asset-price inflation in later decades: it may have encouraged a stock market boom in the '80s and '90s and then, after 2001, a rise in home prices, i.e., the famous [[housing bubble]]. This story, of course, assumes that the amounts of money were the causes of these different types of inflation rather than being endogenous results of the economy's dynamics. | |||

When home prices went down, the Federal Reserve kept its loose monetary policy and lowered interest rates; the attempt to slow price declines in one asset class, e.g. real estate, may well have caused prices in other asset classes to rise, e.g. commoditie.s{{Citation needed|date=September 2009}} | |||

===Rates of growth=== | |||

In terms of percentage changes (to a close approximation under small growth rates,<ref>[http://www.mhhe.com/economics/mcconnell15e/graphics/mcconnell15eco/common/dothemath/percentagechangeapproximation.html ]{{dead link|date=September 2012}}</ref> the percentage change in a product, say XY, is equal to the sum of the percentage changes %ΔX + %ΔY). So: | |||

:%ΔP + %ΔQ = %ΔM + %ΔV | |||

That equation rearranged gives the "basic inflation identity": | |||

:%ΔP = %ΔM + %ΔV – %ΔQ | |||

Inflation (%ΔP) is equal to the rate of money growth (%ΔM), plus the change in velocity (%ΔV), minus the rate of output growth (%ΔQ).<ref>[http://www.hussmanfunds.com/wmc/wmc040524.htm "Breaking Monetary Policy into Pieces"], May 24, 2004</ref> As before, this equation is only useful if %ΔV follows regular behavior. It also loses usefulness if the central bank lacks control over %ΔM. | |||

==Bank reserves at central bank== | |||

{{Globalize|section|date=June 2010}} | |||

When a [[central bank]] is "easing", it triggers an increase in money supply by purchasing [[government bond|government securities]] on the open market thus increasing available funds for private banks to loan through [[fractional-reserve banking]] (the issue of new money through loans) and thus the amount of bank reserves and the monetary base rise. By purchasing government bonds (e.g., [[Treasury bill|U.S. Treasury bills]]), this bids up their prices, so that interest rates fall at the same time that the monetary base increases. | |||

With "easy money," the central bank creates new [[bank reserves]] (in the US known as "[[federal funds]]"), which allow the banks lend more. These loans get spent, and the proceeds get deposited at other banks. Whatever is not required to be held as reserves is then lent out again, and through the "multiplying" effect of the fractional-reserve system, loans and bank deposits go up by many times the initial injection of reserves. | |||

In contrast, when the central bank is "tightening", it slows the process of private bank issue by selling securities on the open market and pulling money (that could be loaned) out of the private banking sector. By increasing the supply of bonds, this lowers their prices and raises interest rates at the same time that the money supply is reduced. | |||

This kind of policy reduces or increases the supply of short term government debt in the hands of banks and the non-bank public, lowering or raising interest rates. In parallel, it increases or reduces the supply of loanable funds (money) and thereby the ability of private banks to issue new money through issuing debt. | |||

The simple connection between monetary policy and monetary aggregates such as M1 and M2 changed in the 1970s as the reserve requirements on deposits started to fall with the emergence of [[money fund]]s, which require no reserves. Then in the early 1990s, reserve requirements, for example in [[Canada]], were dropped to zero<ref>[http://www.bankofcanada.ca/wp-content/uploads/2010/05/wp97-8.pdf "Implementation of Monetary Policy in a Regime with Zero Reserve Requirements"] by Kevin Clinton, [[Bank of Canada]] Working Paper 97-8, April 1997</ref> on [[Savings account|savings deposits]], [[Certificate of deposit|CDs]], and [[Eurodollars|Eurodollar deposit]]. At present, reserve requirements apply only to "[[transactions deposits]]" – essentially [[checking accounts]]. The vast majority of funding sources used by private banks to create loans are not limited by bank reserves. Most commercial and industrial loans are financed by issuing large denomination [[Certificate of deposit|CDs]]. [[Money market]] deposits are largely used to lend to corporations who issue [[commercial paper]]. Consumer loans are also made using [[Savings account|savings deposits]], which are not subject to reserve requirements. This means that instead of the amount of loans supplied responding passively to monetary policy, we often see it rising and falling with the demand for funds and the willingness of banks to lend. | |||

Some academics argue that the money multiplier is a meaningless concept, because its relevance would require that the money supply be [[exogeny|exogenous]], i.e. determined by the monetary authorities via open market operations. If central banks usually target the shortest-term interest rate (as their policy instrument) then this leads to the money supply being [[endogeneity (economics)|endogenous]].<ref>{{cite book |first1=Martijn |last1=Boermans |first2=Basil |last2=Moore |year=2009 |title=Locked-in and Sticky textbooks |url=http://issuu.com/martijnboermans/docs/boermans_moore__2009__-_locked-in_sticky_textbooks |publisher=Issuu.com |accessdate=}}</ref> | |||

{{Update|date=March 2009}} | |||

Neither commercial nor consumer loans are any longer limited by bank reserves. Nor are they directly linked proportional to reserves. Between 1995 and 2008, the amount of consumer loans has steadily increased out of proportion to bank reserves. Then, as part of the financial crisis, bank reserves rose dramatically as new loans shrank. | |||

[[File:Consumer Loans 1990 2008.png|center|Individual Consumer Loans at All Commercial Banks, 1990–2008]] | |||

In recent years, some academic economists renowned for their work on the implications of [[rational expectations]] have argued that open market operations are irrelevant. These include [[Robert Lucas, Jr.]], [[Thomas Sargent]], [[Neil Wallace]], [[Finn E. Kydland]], [[Edward C. Prescott]] and [[Scott Freeman]]. The [[Keynesian]] side points to a major example of ineffectiveness of open market operations encountered in 2008 in the United States, when short-term interest rates went as low as they could go in nominal terms, so that no more monetary stimulus could occur. This [[zero bound]] problem has been called the [[liquidity trap]] or "[[pushing on a string]]" (the pusher being the central bank and the string being the real economy). | |||

==Arguments== | |||

The main functions of the [[central bank]] are to maintain low inflation and a low level of unemployment, although these goals are sometimes in conflict (according to [[Phillips curve]]). A central bank may attempt to do this by artificially influencing the demand for goods by increasing or decreasing the nation's money supply (relative to trend), which lowers or raises interest rates, which stimulates or restrains spending on goods and services. | |||

An important debate among economists in the second half of the twentieth century concerned the central bank's ability to predict how much money should be in circulation, given current employment rates and inflation rates. Economists such as [[Milton Friedman]] believed that the central bank would always get it wrong, leading to wider swings in the economy than if it were just left alone.<ref>{{cite book|title=Capitalism and Freedom|author=[[Milton Friedman]]|year=1962}}</ref> This is why they advocated a non-interventionist approach—one of targeting a pre-specified path for the money supply independent of current economic conditions— even though in practice this might involve regular intervention with [[open market operations]] (or other monetary-policy tools) to keep the money supply on target. | |||

The Chairman of the U.S. Federal Reserve, [[Ben Bernanke]], suggested in 2004 that over the preceding 10 to 15 years, many modern central banks became relatively adept at manipulation of the money supply, leading to a smoother business cycle, with recessions tending to be smaller and less frequent than in earlier decades, a phenomenon termed "[[The Great Moderation]]"<ref>[http://www.federalreserve.gov/boarddocs/speeches/2004/20040220/default.htm FRB: Speech, Bernanke-The Great Moderation-February 20, 2004]. Federal Reserve Bank (February 20, 2004).</ref> This theory encountered criticism during the [[global financial crisis of 2008–2009]].{{Citation needed|date=October 2010}} Furthermore, it may be that the functions of the central bank may need to encompass more than the shifting up or down of interest rates or bank reserves{{Citation needed|date=October 2010}}: these tools, although valuable, may not in fact moderate the volatility of money supply (or its velocity).{{Citation needed|date=October 2010}} | |||

==See also== | |||

{{col-begin}} | |||

{{col-break}} | |||

* [[A Program for Monetary Reform]] | |||

* [[American Monetary Institute]] | |||

* [[Bank regulation]] | |||

* [[Capital requirement]] | |||

* [[Central bank]] | |||

* [[Chartalism]] | |||

* [[Chicago plan]] | |||

* [[The Chicago Plan Revisited]] | |||

* [[Committee on Monetary and Economic Reform]] | |||

* [[Core inflation]] | |||

* [[Debt levels and flows]] | |||

* [[Economics terminology that differs from common usage]] | |||

* [[Fiat currency]] | |||

* [[Financial capital]] | |||

* [[Float (money supply)|Float]] | |||

* [[Fractional-reserve banking]] | |||

{{col-break}} | |||

* [[FRED (Federal Reserve Economic Data)]] | |||

* [[Full reserve banking]] | |||

* [[Index of Leading Indicators]] – money supply is a component | |||

* [[Inflation]] | |||

* [[Monetarism]] | |||

* [[Monetary base]] | |||

* [[Monetary economics]] | |||

* [[Monetary reform]] | |||

* [[Money circulation]] | |||

* [[Money creation]] | |||

* [[Money demand]] | |||

* [[Money market]] | |||

* [[Money with zero maturity]] (MZM) | |||

* [[NEED Act]] | |||

* [[Seigniorage]] | |||

{{col-end}} | |||

==References== | |||

{{Reflist|30em}} | |||

==Further reading== | |||

* [http://www.dictionaryofeconomics.com/article?id=pde2008_M000236&goto=moneysupply&result_number=2372 Article in the New Palgrave on Money Supply] by [[Milton Friedman]] | |||

* [http://www.frbsf.org/education/activities/drecon/2001/0111.html Do all banks hold reserves, and, if so, where do they hold them? (11/2001)] | |||

* [http://www.frbsf.org/education/activities/drecon/2001/0108.html What effect does a change in the reserve requirement have on the money supply? (08/2001)] | |||

* [http://research.stlouisfed.org/aggreg/ St. Louis Fed: Monetary Aggregates] | |||

* {{cite encyclopedia |last1=Schwartz |first1=Anna J. |authorlink1= Anna Schwartz |last2= |first2= |authorlink2= |editor= [[David R. Henderson]] (ed.) |encyclopedia=[[Concise Encyclopedia of Economics]] |title=Money Supply |url=http://www.econlib.org/library/Enc/MoneySupply.html |year=2008 |edition= 2nd |publisher=[[Library of Economics and Liberty]] |location=Indianapolis |isbn=978-0865976658 |oclc=237794267}} | |||

* [http://www.federalreserve.gov/releases/h6/discm3.htm Discontinuance of M3 Publication] | |||

* [http://www.investopedia.com/terms/m/moneyzeromaturity.asp Investopedia: Money Zero Maturity (MZM)] | |||

* {{Cite encyclopedia | |||

| last =White | |||

| first =Lawrence H. | |||

| author-link = Lawrence H. White | |||

| title =Competing Money Supplies | |||

| publisher =[[Library of Economics and Liberty]] | |||

|editor= [[David R. Henderson]] (ed.) | |||

|encyclopedia=[[Concise Encyclopedia of Economics]] | |||

| year =2008 | |||

| edition =2nd | |||

| url =http://www.econlib.org/library/Enc/CompetingMoneySupplies.html | |||

| isbn =978-0865976658 | |||

| oclc = 237794267}} | |||

==External links== | |||

* [http://www.federalreserve.gov/releases/h3/Current/h3.htm Aggregate Reserves Of Depository Institutions And The Monetary Base (H.3)] | |||

* [http://www.bitcoin.org Bitcoin.org] | |||

* [http://fraser.stlouisfed.org/publication/?pid=88 Historical H.3 releases] | |||

* [http://www.federalreserve.gov/releases/h6/hist/h6hist1.txt U.S. M1,M2 Money Supply Historical Table] | |||

* [http://www.federalreserve.gov/releases/h6/current/default.htm Money Stock Measures (H.6)] | |||

* [http://research.stlouisfed.org/fred2/series/MZMV U.S. MZM magnitude] and [http://research.stlouisfed.org/fred2/series/MZMV velocity], used as a predictor of [[inflation]] | |||

* [http://www.rba.gov.au/Statistics/AlphaListing/alpha_listing_m.html Data on Monetary Aggregates in Australia] | |||

* [http://www.info.gov.hk/hkma/eng/press/category/statistics_index.htm Monetary Statistics on Hong Kong Monetary Authority] | |||

* [http://www.pbc.gov.cn/english/ Monetary Survey] from [[People's Bank of China]] | |||

* [http://demonstrations.wolfram.com/MoneySupplyProcess/ Money Supply Process] by Fiona Maclachlan, [[Wolfram Demonstrations Project]]. | |||

<!-- The charts in this article should all have a logarithmic scale on the y axis, otherwise they give the wrong impression! --> | |||

{{DEFAULTSORT:Money Supply}} | |||

[[Category:Economics terminology]] | |||

[[Category:Money]] | |||

[[Category:Monetary economics]] | |||

[[Category:Monetary policy]] | |||

[[Category:Inflation]] | |||

Revision as of 23:54, 5 December 2013

Template:Use mdy dates Template:Finance sidebar In economics, the money supply or money stock, is the total amount of monetary assets available in an economy at a specific time.[1] There are several ways to define "money," but standard measures usually include currency in circulation and demand deposits (depositors' easily accessed assets on the books of financial institutions).[2][3]

Money supply data are recorded and published, usually by the government or the central bank of the country. Public and private sector analysts have long monitored changes in money supply because of its effects on the price level, inflation, the exchange rate and the business cycle.[4]

That relation between money and prices is historically associated with the quantity theory of money. There is strong empirical evidence of a direct relation between money-supply growth and long-term price inflation, at least for rapid increases in the amount of money in the economy. That is, a country such as Zimbabwe which saw rapid increases in its money supply also saw rapid increases in prices (hyperinflation). This is one reason for the reliance on monetary policy as a means of controlling inflation.[5][6]

The nature of this causal chain is the subject of contention. Some heterodox economists argue that the money supply is endogenous (determined by the workings of the economy, not by the central bank) and that the sources of inflation must be found in the distributional structure of the economy.[7]

In addition, those economists seeing the central bank's control over the money supply as feeble say that there are two weak links between the growth of the money supply and the inflation rate. First, in the aftermath of a recession, when many resources are underutilized, an increase in the money supply can cause a sustained increase in real production instead of inflation. Second, if the velocity of money, i.e., the ratio between nominal GDP and money supply changes, an increase in the money supply could have either no effect, an exaggerated effect, or an unpredictable effect on the growth of nominal GDP.

Empirical measures in the United States Federal Reserve System

- See also European Central Bank for other approaches and a more global perspective.

Money is used as a medium of exchange, a unit of account, and as a ready store of value. Its different functions are associated with different empirical measures of the money supply. There is no single "correct" measure of the money supply. Instead, there are several measures, classified along a spectrum or continuum between narrow and broad monetary aggregates. Narrow measures include only the most liquid assets, the ones most easily used to spend (currency, checkable deposits). Broader measures add less liquid types of assets (certificates of deposit, etc.).

This continuum corresponds to the way that different types of money are more or less controlled by monetary policy. Narrow measures include those more directly affected and controlled by monetary policy, whereas broader measures are less closely related to monetary-policy actions.[6] It is a matter of perennial debate as to whether narrower or broader versions of the money supply have a more predictable link to nominal GDP.

The different types of money are typically classified as "M"s. The "M"s usually range from M0 (narrowest) to M3 (broadest) but which "M"s are actually focused on in policy formulation depends on the country's central bank. The typical layout for each of the "M"s is as follows:

| Type of money | M0 | MB | M1 | M2 | M3 | MZM |

|---|---|---|---|---|---|---|

| Notes and coins in circulation (outside Federal Reserve Banks and the vaults of depository institutions) (currency) | ✓[8] | ✓ | ✓ | ✓ | ✓ | ✓ |

| Notes and coins in bank vaults (Vault Cash) | ✓ | |||||

| Federal Reserve Bank credit (required reserves and excess reserves not physically present in banks) | ✓ | |||||

| Traveler's checks of non-bank issuers | ✓ | ✓ | ✓ | ✓ | ||

| Demand deposits | ✓ | ✓ | ✓ | ✓ | ||

| Other checkable deposits (OCDs), which consist primarily of Negotiable Order of Withdrawal (NOW) accounts at depository institutions and credit union share draft accounts. | ✓[9] | ✓ | ✓ | ✓ | ||

| Savings deposits | ✓ | ✓ | ✓ | |||

| Time deposits less than $100,000 and money-market deposit accounts for individuals | ✓ | ✓ | ||||

| Large time deposits, institutional money market funds, short-term repurchase and other larger liquid assets[10] | ✓ | |||||

| All money market funds | ✓ |

- Template:Visible anchor: In some countries, such as the United Kingdom, M0 includes bank reserves, so M0 is referred to as the monetary base, or narrow money.[11]

- MB: is referred to as the monetary base or total currency.[8] This is the base from which other forms of money (like checking deposits, listed below) are created and is traditionally the most liquid measure of the money supply.[12]

- M1: Bank reserves are not included in M1.

- M2: Represents M1 and "close substitutes" for M1.[13] M2 is a broader classification of money than M1. M2 is a key economic indicator used to forecast inflation.[14]

- M3: M2 plus large and long-term deposits. Since 2006, M3 is no longer tracked by the US central bank.[15] However, there are still estimates produced by various private institutions.

- MZM: Money with zero maturity. It measures the supply of financial assets redeemable at par on demand. Velocity of MZM is historically a relatively accurate predictor of inflation.[16][17][18]

The ratio of a pair of these measures, most often M2 / M0, is called an (actual, empirical) money multiplier.

Fractional-reserve banking

Mining Engineer (Excluding Oil ) Truman from Alma, loves to spend time knotting, largest property developers in singapore developers in singapore and stamp collecting. Recently had a family visit to Urnes Stave Church. The different forms of money in government money supply statistics arise from the practice of fractional-reserve banking. Whenever a bank gives out a loan in a fractional-reserve banking system, a new sum of money is created. This new type of money is what makes up the non-M0 components in the M1-M3 statistics. In short, there are two types of money in a fractional-reserve banking system:[19][20]

- central bank money (obligations of a central bank, including currency and central bank depository accounts)

- commercial bank money (obligations of commercial banks, including checking accounts and savings accounts)

In the money supply statistics, central bank money is MB while the commercial bank money is divided up into the M1-M3 components. Generally, the types of commercial bank money that tend to be valued at lower amounts are classified in the narrow category of M1 while the types of commercial bank money that tend to exist in larger amounts are categorized in M2 and M3, with M3 having the largest.

In the US, reserves consist of money in Federal Reserve accounts and US currency held by banks (also known as "vault cash").[21] Currency and money in Fed accounts are interchangeable (both are obligations of the Fed.) Reserves may come from any source, including the federal funds market, deposits by the public, and borrowing from the Fed itself.[22]

A reserve requirement is a ratio a bank must maintain between deposits and reserves.[23] Reserve requirements do not apply to the amount of money a bank may lend out. The ratio that applies to bank lending is its capital requirement.[24]

Example

Note: The examples apply when read in sequential order.

M0

- Laura has ten US $100 bills, representing $1000 in the M0 supply for the United States. (MB = $1000, M0 = $1000, M1 = $1000, M2 = $1000)

- Laura burns one of her $100 bills. The US M0, and her personal net worth, just decreased by $100. (MB = $900, M0 = $900, M1 = $900, M2 = $900)

M1

- Laura takes the remaining nine bills and deposits them in her transactional account (checking account or current account by country) at her bank. (MB = $900, M0 = 0, M1 = $900, M2 = $900)

- The bank then calculates its reserve using the minimum reserve percentage given by the Fed and loans the extra money. If the minimum reserve is 10%, this means $90 will remain in the bank's reserve. The remaining $810 can only be used by the bank as credit, by lending money, but until that happens it will be part of the bank's excess reserves.

- The M1 money supply increases by $810 when the loan is made. M1 money is created. ( MB = $900 M0 = $810, M1 = $1710, M2 = $1710)

- Laura writes a check for $400, check number 7771. The total M1 money supply didn't change, it includes the $400 check and the $500 left in her account. (MB = $900, M0 = 0, M1 = $1710, M2 = $1710)

- Laura's check number 7771 is accidentally destroyed in the laundry. M1 and her checking account do not change, because the check is never cashed. (MB = $900, M0 = 0, M1 = $1710, M2 = $1710)

- Laura writes check number 7772 for $100 to her friend Alice, and Alice deposits it into her checking account. MB does not change, it still has $900 in it, Alice's $100 and Laura's $800. (MB = $900, M0 = 0, M1 = $1710, M2 = $1710)

- The bank lends Mandy the $810 credit that it has created. Mandy deposits the money in a checking account at another bank. The other bank must keep $81 as a reserve and has $729 available for loans. This creates a promise-to-pay money from a previous promise-to-pay, thus the M1 money supply is now inflated by $729. (MB = $900, M0 = 0, M1 = $2439, M2 = $2439)

- Mandy's bank now lends the money to someone else who deposits it on a checking account on yet another bank, who again stores 10% as reserve and has 90% available for loans. This process repeats itself at the next bank and at the next bank and so on, until the money in the reserves backs up an M1 money supply of $9000, which is 10 times the MB money. (MB = $900, M0 = 0, M1 = $9000, M2 = $9000)

M2

- Laura writes check number 7774 for $1000 and brings it to the bank to start a Money Market account (these do not have a credit-creating charter), M1 goes down by $1000, but M2 stays the same. This is because M2 includes the Money Market account in addition to all money counted in M1.

Foreign Exchange

- Laura writes check number 7776 for $200 and brings it downtown to a foreign exchange bank teller at Credit Suisse to convert it to British Pounds. On this particular day, the exchange rate is exactly USD 2.00 = GBP 1.00. The bank Credit Suisse takes her $200 check, and gives her two £50 notes (and charges her a dollar for the service fee). Meanwhile, at the Credit Suisse branch office in Hong Kong, a customer named Huang has £100 and wants $200, and the bank does that trade (charging him an extra £.50 for the service fee). US M0 still has the $900, although Huang now has $200 of it. The £100 notes Laura walks off with are part of Britain's M0 money supply that came from Huang.

- The next day, Credit Suisse finds they have an excess of GB Pounds and a shortage of US Dollars, determined by adding up all the branch offices' supplies. They sell some of their GBP on the open FX market with Deutsche Bank, which has the opposite problem. The exchange rate stays the same.

- The day after, both Credit Suisse and Deutsche Bank find they have too many GBP and not enough USD, along with other traders. Then, to move their inventories, they have to sell GBP at USD 1.999, that is, 1/10-cent less than $2 per pound, and the exchange rate shifts. None of these banks has the power to increase or decrease the British M0 or the American M0 (unless they burn bills); they are independent systems.

Money supplies around the world

United States

The Federal Reserve previously published data on three monetary aggregates, but on November 10, 2005 announced that as of March 23, 2006, it would cease publication of M3.[15] Since the Spring of 2006, the Federal Reserve only publishes data on two of these aggregates. The first, M1, is made up of types of money commonly used for payment, basically currency (M0) and checking account balances. The second, M2, includes M1 plus balances that generally are similar to transaction accounts and that, for the most part, can be converted fairly readily to M1 with little or no loss of principal. The M2 measure is thought to be held primarily by households. As mentioned, the third aggregate, M3 is no longer published. Prior to this discontinuation, M3 had included M2 plus certain accounts that are held by entities other than individuals and are issued by banks and thrift institutions to augment M2-type balances in meeting credit demands; it had also included balances in money market mutual funds held by institutional investors. The aggregates have had different roles in monetary policy as their reliability as guides has changed. The following details their principal components:[26]

- M0: The total of all physical currency including coinage. M0 = Federal Reserve Notes + US Notes + Coins. It is not relevant whether the currency is held inside or outside of the private banking system as reserves.

- MB: The total of all physical currency plus Federal Reserve Deposits (special deposits that only banks can have at the Fed). MB = Coins + US Notes + Federal Reserve Notes + Federal Reserve Deposits

- M1: The total amount of M0 (cash/coin) outside of the private banking system plus the amount of demand deposits, travelers checks and other checkable deposits

- M2: M1 + most savings accounts, money market accounts, retail money market mutual funds, and small denomination time deposits (certificates of deposit of under $100,000).

- MZM: 'Money Zero Maturity' is one of the most popular aggregates in use by the Fed because its velocity has historically been the most accurate predictor of inflation. It is M2 – time deposits + money market funds

- M3: M2 + all other CDs (large time deposits, institutional money market mutual fund balances), deposits of eurodollars and repurchase agreements.

- M4-: M3 + Commercial Paper

- M4: M4- + T-Bills (or M3 + Commercial Paper + T-Bills)

- L: The broadest measure of liquidity that the Federal Reserve no longer tracks. Pretty much M4 + Bankers' Acceptance

- Money Multiplier: M1 / MB. Currently as of June 14, 2012 it is .85. While a multiplier under one is historically an oddity, this is a reflection of the popularity of M2 over M1 and the massive amount of MB the government has created since 2008.

It should be noted that while the treasury can and does hold cash and a special deposit account at the Fed (fed funds), these assets do not count in any of the aggregates. So in essence taxes paid to the Federal Government (Treasury) is excluded from the money supply. To counter this, the government created the TT&L program in which any receipts above a certain threshold are redeposited in private banks. The idea is that tax receipts won't decrease the amount of reserves in the banking system. The TT&L accounts, while demand deposits, do not count toward M1 or any other aggregate as well.

When the Federal Reserve announced in 2005 that they would cease publishing M3 statistics in March 2006, they explained that M3 did not convey any additional information about economic activity compared to M2, and thus, "has not played a role in the monetary policy process for many years." Therefore, the costs to collect M3 data outweighed the benefits the data provided.[15] Some politicians have spoken out against the Federal Reserve's decision to cease publishing M3 statistics and have urged the U.S. Congress to take steps requiring the Federal Reserve to do so. Congressman Ron Paul (R-TX) claimed that "M3 is the best description of how quickly the Fed is creating new money and credit. Common sense tells us that a government central bank creating new money out of thin air depreciates the value of each dollar in circulation."[27] Modern Monetary Theory disagrees. It holds that money creation in a free-floating fiat currency regime such as the U.S. will not lead to significant inflation unless the economy is approaching full employment and full capacity. Some of the data used to calculate M3 are still collected and published on a regular basis.[15] Current alternate sources of M3 data are available from the private sector.[28]

As of April 2013, the monetary base was $3 trillion[29] and M2, the broadest measure of money supply, was $10.5 trillion.[30]

United Kingdom

There are just two official UK measures. M0 is referred to as the "wide monetary base" or "narrow money" and M4 is referred to as "broad money" or simply "the money supply".

- M0: Cash outside Bank of England + banks' operational deposits with Bank of England. (No longer published.)

- M4: Cash outside banks (i.e. in circulation with the public and non-bank firms) + private-sector retail bank and building society deposits + private-sector wholesale bank and building society deposits and certificates of deposit.[31] In 2010, the total money supply (M4) measure in the UK was £2.2 trillion while the actual notes and coins in circulation was only £47 billion, 2.1% of the actual money supply.[32]

There are several different definitions of money supply to reflect the differing stores of money. Due to the nature of bank deposits, especially time-restricted savings account deposits, the M4 represents the most illiquid measure of money. M0, by contrast, is the most liquid measure of the money supply.Benefits of Residing in a Apartment or Landed property in Singapore Property New Launches & Project Showcase In Singapore Many residential Singapore property sales involve buying property in Singapore at new launches. These are often homes underneath building, being sold new by developers. New Launch Singapore Property, 28 Imperial Residences Coming To Geylang Lorong 26 The property market is slowing down, based on personal property transactions in May Cell Apps FREE Sign Up Log in Property Brokers Feedback

Individuals all wish to be seen having the identical foresight as the experts in property investment or the massive names in their own fields. Thus the discharge of these tales works to encourage different buyers to observe suit. Bartley Ridge is the most popular new launch in district 13. Irresistible pricing from $1,1xx psf. Bartley Ridge is a ninety nine-12 months leasehold new condominium at Mount Vernon road, good next to Bartley MRT station (CC12). If you want to get more Rehda Johor chairman Koh Moo Hing said potential property consumers in the two areas Http://Modern.Dowatch.Net/Profile/Mic31K/Created/Topics are now adopting a wait-and-see attitude. How can I get the ebrochure and flooring plans of the new launch projects ? The Existing Mortgage on your HDB District 13, Freehold condominium District 11, Freehold Cluster landed house Sea Horizon EC @ Pasir Ris

FindSgNewLaunch is the main Singapore Property web site - one of the best place to begin your actual estate search whether you might be an investor, shopping for for own use, or searching for a spot to lease. With detailed details about each property, together with maps and pictures. We deliver you probably the most complete choice out there. No. For brand spanking new Singapore property gross sales, you possibly can withdraw at any time earlier than booking the unit, without penalty. On the preview, the agent will let you recognize the exact worth for you to resolve whether or not to proceed or not. Solely when you resolve to proceed will the agent book the unit for you. Pending for Sale Licence Approval All Pending for Sale Licence Approval New launch FREEHOLD condominium @ Braddell New launch condominium combined growth at Yishun PROJECT TITLE

To not worry, we'll hold you in our VIP Precedence list for future new launch VIP Preview. We'll contact you to establish your wants and advocate related tasks, both new launch or resale properties that probably match your standards. In case you're looking for resale property, such as these few years old, or just got Short-term Occupation Permit (PRIME), you might click on here right here for fast search and submit your shortlisted listings to us, we'll check and call you for viewing.

Oceanfront Suites, irresistible pricing for a 946 leasehold property with magnificent sea view. Dreaming of basking and feeling the warmth of pure sunlight is now just a click on away. Oceanfront Suites - Seaside residing no longer needs to remain an unattainable This Cambodia new launch, a mega development has also 762 residential models. Additionally located within this Oxley abroad property is a mega shopping center with 627 outlets and also up to 963 available workplace spaces and is surrounded by quite a few Embassy, resorts, Casinos and many vacationer relax space. Belysa EC @ Pasir Ris Esparina EC @ Sengkang Dell Launches World's first Gender-GEDI Female Entrepreneurship Index on 06/04/thirteen by Istanbul, Turkey. Paris Ris EC @ Paris Ris in search of indication of curiosity.

The developer should open a Venture Account with a financial institution or monetary establishment for every housing venture he undertakes, before he's issued with a Sale License (license to sell models in his development). All payments from buyers before completion of the challenge, and construction loans, go into the mission account. New launch rental LA FIESTA, an thrilling new condominium located along Sengkang Square / Compassvale Highway is a brief stroll to the bustling Sengkang City Centre the place the bus interchange, Sengkang MRT and LRT stations are located. Glorious location,Premium rental with Bayfront resort lifestyle theme and views ofwaterscape. Close to EC pricing - Worth for cash! Apr 02, 2013 Sengkang New Rental Launch, La Fiesta- Sengkang MRTstation at your gate.

As The Hillford property launch at Jalan Jurong Kechil may be very close to to beauty world mrt , the environment for the plot of land which belongs to World Class Land remains very upbeat as it is rather close to to Holland Village. Review now by visiting the brand new apartment pages on our website, each displaying complete particulars and the latest information of each new launch. You can even contact us directly to obtain quick & correct answers to all of your questions with high of the road service. An inevitable conclusion is that costs within the property market have just set new highs. The apparent connotation for potential buyers is to take motion now before prices bounce again. tract and points to his property line, marked by a big maple in a sea of Search SG Developersale.com

Eurozone

The European Central Bank's definition of euro area monetary aggregates:[33]

- M1: Currency in circulation + overnight deposits

- M2: M1 + deposits with an agreed maturity up to 2 years + deposits redeemable at a period of notice up to 3 months.

- M3: M2 + repurchase agreements + money market fund (MMF) shares/units + debt securities up to 2 years

Benefits of Residing in a Apartment or Landed property in Singapore Property New Launches & Project Showcase In Singapore Many residential Singapore property sales involve buying property in Singapore at new launches. These are often homes underneath building, being sold new by developers. New Launch Singapore Property, 28 Imperial Residences Coming To Geylang Lorong 26 The property market is slowing down, based on personal property transactions in May Cell Apps FREE Sign Up Log in Property Brokers Feedback

Individuals all wish to be seen having the identical foresight as the experts in property investment or the massive names in their own fields. Thus the discharge of these tales works to encourage different buyers to observe suit. Bartley Ridge is the most popular new launch in district 13. Irresistible pricing from $1,1xx psf. Bartley Ridge is a ninety nine-12 months leasehold new condominium at Mount Vernon road, good next to Bartley MRT station (CC12). If you want to get more Rehda Johor chairman Koh Moo Hing said potential property consumers in the two areas Http://Modern.Dowatch.Net/Profile/Mic31K/Created/Topics are now adopting a wait-and-see attitude. How can I get the ebrochure and flooring plans of the new launch projects ? The Existing Mortgage on your HDB District 13, Freehold condominium District 11, Freehold Cluster landed house Sea Horizon EC @ Pasir Ris

FindSgNewLaunch is the main Singapore Property web site - one of the best place to begin your actual estate search whether you might be an investor, shopping for for own use, or searching for a spot to lease. With detailed details about each property, together with maps and pictures. We deliver you probably the most complete choice out there. No. For brand spanking new Singapore property gross sales, you possibly can withdraw at any time earlier than booking the unit, without penalty. On the preview, the agent will let you recognize the exact worth for you to resolve whether or not to proceed or not. Solely when you resolve to proceed will the agent book the unit for you. Pending for Sale Licence Approval All Pending for Sale Licence Approval New launch FREEHOLD condominium @ Braddell New launch condominium combined growth at Yishun PROJECT TITLE

To not worry, we'll hold you in our VIP Precedence list for future new launch VIP Preview. We'll contact you to establish your wants and advocate related tasks, both new launch or resale properties that probably match your standards. In case you're looking for resale property, such as these few years old, or just got Short-term Occupation Permit (PRIME), you might click on here right here for fast search and submit your shortlisted listings to us, we'll check and call you for viewing.

Oceanfront Suites, irresistible pricing for a 946 leasehold property with magnificent sea view. Dreaming of basking and feeling the warmth of pure sunlight is now just a click on away. Oceanfront Suites - Seaside residing no longer needs to remain an unattainable This Cambodia new launch, a mega development has also 762 residential models. Additionally located within this Oxley abroad property is a mega shopping center with 627 outlets and also up to 963 available workplace spaces and is surrounded by quite a few Embassy, resorts, Casinos and many vacationer relax space. Belysa EC @ Pasir Ris Esparina EC @ Sengkang Dell Launches World's first Gender-GEDI Female Entrepreneurship Index on 06/04/thirteen by Istanbul, Turkey. Paris Ris EC @ Paris Ris in search of indication of curiosity.

The developer should open a Venture Account with a financial institution or monetary establishment for every housing venture he undertakes, before he's issued with a Sale License (license to sell models in his development). All payments from buyers before completion of the challenge, and construction loans, go into the mission account. New launch rental LA FIESTA, an thrilling new condominium located along Sengkang Square / Compassvale Highway is a brief stroll to the bustling Sengkang City Centre the place the bus interchange, Sengkang MRT and LRT stations are located. Glorious location,Premium rental with Bayfront resort lifestyle theme and views ofwaterscape. Close to EC pricing - Worth for cash! Apr 02, 2013 Sengkang New Rental Launch, La Fiesta- Sengkang MRTstation at your gate.

As The Hillford property launch at Jalan Jurong Kechil may be very close to to beauty world mrt , the environment for the plot of land which belongs to World Class Land remains very upbeat as it is rather close to to Holland Village. Review now by visiting the brand new apartment pages on our website, each displaying complete particulars and the latest information of each new launch. You can even contact us directly to obtain quick & correct answers to all of your questions with high of the road service. An inevitable conclusion is that costs within the property market have just set new highs. The apparent connotation for potential buyers is to take motion now before prices bounce again. tract and points to his property line, marked by a big maple in a sea of Search SG Developersale.com

Australia

The Reserve Bank of Australia defines the monetary aggregates as:[34]

- M1: currency bank + current deposits of the private non-bank sector

- M3: M1 + all other bank deposits of the private non-bank sector

- Broad Money: M3 + borrowings from the private sector by NBFIs, less the latter's holdings of currency and bank deposits

- Money Base: holdings of notes and coins by the private sector plus deposits of banks with the Reserve Bank of Australia (RBA) and other RBA liabilities to the private non-bank sector

Benefits of Residing in a Apartment or Landed property in Singapore Property New Launches & Project Showcase In Singapore Many residential Singapore property sales involve buying property in Singapore at new launches. These are often homes underneath building, being sold new by developers. New Launch Singapore Property, 28 Imperial Residences Coming To Geylang Lorong 26 The property market is slowing down, based on personal property transactions in May Cell Apps FREE Sign Up Log in Property Brokers Feedback